We thank Aiera, an AI-powered equity research platform, for accelerating our data and insight extraction process.

Summary:

In September, the Flybridge AI Index returned 8%. For the prior 12 months, the Index has returned 43% to its current level of 120% since January of 2023.

Of the 32 active companies in the Index, 27 gained in August and 5 declined in the month. Significant gainers include Astera Labs (+34%), and Palantir (+22%). Significant decliners include Adobe (-9%), and Simulation Plus (-8%).

We deep dive into ServiceNow's GenAI strategy and how it is well-positioned or not in this new wave

ServiceNow deep dive: Can traditional Enterprise Software Lead the Gen AI Revolution?

In this month's Flybridge AI Index update, we're trying something new. We will do a deep dive into one of the constituents of the Index: ServiceNow. Given that so much attention has been focused on the compute layer players like NVIDIA, we decided to ask the $600 billion question: how will all the compute investment translate (or not) into the application layer? We chose ServiceNow because it has made bold statements about its GenAI strategy.

ServiceNow is a nearly $10B in revenue company that provides a SaaS platform to automates organizational processes. With a market capitalization of over $180 billion, it is the world's 9th most valuable software company, sitting just behind Salesforce, Adobe, and IBM.

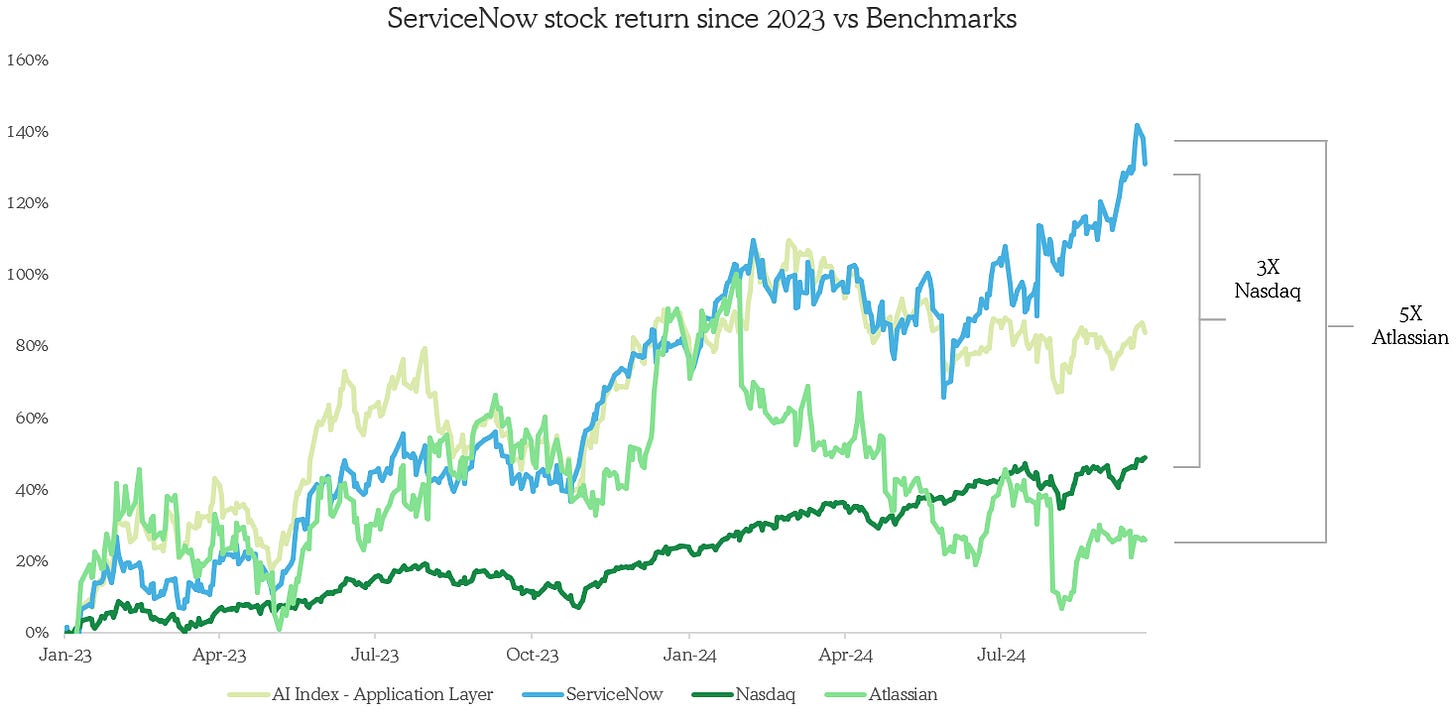

Has it benefited disproportionately from the AI wave so far? The answer appears to be a resounding yes. From the inception date of the Flybridge AI Index, ServiceNow has outperformed the NASDAQ by 3x and its nearest competitor, Atlassian, by 5x since 2023.

Data as of September 27, 2024

ServiceNow was founded by Fred Luddy in 2004 in California and went public in 2012 (For those interested in the history of the company, I highly recommend this interview with Fred about the crucible moments of the company and if you are a VC focused on sourcing great investment opportunities, Pat Grady’s posts on X are a good quick read on persistence!) Current CEO Bill McDermott is a software industry veteran and formerly CEO of SAP.

Historical performance

At the end of 2023, ServiceNow had over 8,000 customers (16% penetration of their internal estimate of 50,000+ potential customers) and generated $8 billion in revenue. Analysts estimate that the company will generate $9.9 billion in revenue in 2024, growing 24% year-over-year, with a 79% gross margin and a 16% EBITDA margin. This is exactly a Rule of 40 company and an impressive combination of growth at scale and profitability. Not surprisingly, the company commands a premium multiple, trading at 15x EV/NTM revenue as compared to the software industry average of 6-7x (see Appendix for growth rate and EBITDA margin comparisons with other constituents from the index).

Data from Capital Iq as of September 30,2024

Product offering and market expansion

ServiceNow started with cloud-based IT service management (ITSM), but expanded to become an end-to-end intelligent workflow automation platform across different workflows and internal processes. They aim to replace multiple complex software solutions with a unified platform. Beyond IT workflows, they now offer: Customer/Industry Workflows (Connecting front, middle, and back offices to improve customer experience and loyalty), Employee Workflows (Simplifying employee access to services with a consumer-like experience), and Creator Workflows (Enabling customers to create low-code applications on the Now Platform).

The history of ServiceNow offers valuable insights for founders, from how they expanded from their initial point solution in the ITSM market in 2005 to now pursuing a $275 billion market opportunity, covering technology workflows ($108 billion), employee workflows ($15 billion), customer and industry workflows ($68 billion), and creator workflows ($84 billion). The slides below show this progression.

ServiceNow financial analyst day 2024

While past performance doesn't guarantee future success, the company's strong track record in market expansion and technology adaptation suggests they may be well positioned to capitalize on the generative AI wave. Short term, they estimate a $1Bn+ opportunity from existing pro customers and $2.5Bn from service desk customers.

A challenge for ServiceNow is that more specialized companies (e.g., in HR) might iterate faster and embed an even broader and more accurate set of generative AI-powered features in those specific segments. However, ServiceNow’s broad integration across systems (HR, IT, etc.) could allow them to exponentially increase customer value, as generative AI enhances their ability to interpret and connect data from various systems.

AI products/features

ServiceNow has been leveraging AI across their products for predictive and document intelligence for some time. However, since 2023 when they announced the introduction of Gen AI capabilities, they have been quickly shipping new GenAI powered products and features. Some of the most interesting ones include:

NowAssist: An AI assistant integrated into ServiceNow platforms enabling natural language interactions for various tasks. It handles text summarization, case deflection through conversations, dynamic experiences, automated resolution note generation, content creation, and code and flow generation with text-to-code conversion.

Recently, they announced their AI agents to orchestrate workflows, integrations, and data. These agents enable the majority of tasks to be performed, showing step-by-step actions taken and allowing a human agent to review and approve the recommended actions, as shown below.

Created a personalized AI assistant for employees that leverages knowledge graphs to provide proactive, and personalized experience. For instance, when an employee requests a laptop, the system already knows her current devices (e.g., an unreturned laptop, active phone, monitors), software usage, management hierarchy, and collaboration patterns. This rich context, stored in the Knowledge Graph, enables the AI to make intelligent decisions and provide personalized assistance.

Founders often debate whether to use out-of-the-box models or fine-tune their own. ServiceNow is developing Now LLM, a language model trained on domain-specific data to enhance performance, accuracy, speed, and privacy, and offering it via Now Assist. While they mentioned narrow use cases like summarization and KB article creation, details are sparse, and it's unclear what level of improvement or cost savings these models will bring. It is worth noting that they do enable companies to bring their own models and leverage models of other providers.

Startups often have the advantage of speed, but ServiceNow is impressively embracing rapid execution for a company of its size. Among the constituents of the AI index, they’ve been one of the fastest in launching new generative AI-powered features, committing to announcements every six months, with the next update expected in Q2-2025. Their experimentation—like AI multimodal avatars in partnership with NVIDIA—shows a willingness to test new ideas, even if some early versions aren't perfect. Despite this impressive speed of execution, they are a large incumbent, so it remains to be seen if they will be able to sustain this accelerated pace, and if they have the proper mechanisms in place for a fast-executing culture, or if they will eventually have to slow down if things start to “break.”.

While it's too early to determine ServiceNow's long-term success, early results are promising. In Q2, Now Assist's net new ACV doubled quarter-over-quarter, making it the company's fastest-growing product. They secured 11 Now Assist deals over $1M in NACV, with some exceeding $5M. Internally, Now Assist has saved the IT desk 45 minutes per avoided case and 30 minutes per automatically generated knowledge article. Employees are projected to save 21,000 hours through faster self-service, and their Plus Plan (GenAI SKU) is driving a 30%+ price uplift over Pro Plus.

Customer Segmentation

ServiceNow targets large enterprises in industries like Telecom, Media & Tech, healthcare, life sciences, financial services, manufacturing, public sector, and retail. In 2023, the number of customers with ACV greater than $1M was 1.9k, up from 1.3k in 2021, with an estimated of 85% of Fortune 500 companies using ServiceNow. Among these, they have 55 accounts with $20M+ ACV. Some of the companies using their Gen AI-powered features include Equinix, Stellantis, Merck, Adobe, and Dell.

One of the challenges is that ServiceNow customers are paying a substantial amount for their software. Although Annual Contract Values have been increasing so far, there is a risk that as Generative AI enables faster application development, customers may decide to build in-house solutions or procure external ones from newer, less expensive AI-native startups at a fraction of the cost, given the potential impact on their P&L. This is especially true in areas like IT Service Management (ITSM) that have low barriers to entry and where much of the core functionality tends to be commoditized.

However, the big challenge for disruptors is that studies suggest large enterprises are more inclined to procure AI-enabled products from existing vendors, as shown by a recent Iconiq Growth report, which surveyed over 200 executives from enterprises with $500M+ in revenue, and showed that 63% of CXOs preferred to source AI solutions from existing vendors.

ICONIQ Growth - 2024 State of AI Report

In this sense, ServiceNow could be well-positioned to upsell with generative AI products, especially in spaces like ITSM, where they have an estimated 40% market share. Additionally, their customers seem to like the product, at least based on a consistent ~98% ACV renewal rate they’ve maintained over multiple years.

M&A and venture arm

One area where ServiceNow has been very active in the past year is in M&A and direct investment. The good news for startups is that they have ServiceNow Ventures, an investment arm through which they have committed to invest $1 billion by 2026. Their strategy is to invest in companies that can add value to their platform and ecosystem, and to gain visibility into future market trends, especially around AI. According to their website, they have invested in companies like DataRobot and Mistral. In addition, they have been very active in acquisitions, acquiring Raytion in July, IntellA in May, and 4Industry BV in March.

Based on their recent acquisitions, it is clear how they are using these to accelerate their process of improving their generative AI offering. For example, their latest acquisition of Raytion will enhance their AI-powered search capabilities. This acquisition enables real-time access to data across multiple enterprise sources by integrating Raytion's information retrieval technology with ServiceNow's AI Search, thereby increasing the value of managing multiple customer workflows.

Final thoughts

Although it's hard to predict the future, ServiceNow appears well-positioned to leverage generative AI and expand its market potential, particularly in the IT workflow segment. The company's key advantage lies in its access to and integration with various enterprise systems. This connectivity, and access to the underlying cross functional data, could afford the company the opportunity to build high-performance fine-tuned models and capabilities to streamline and automate work on behalf of their customers. Additionally, ServiceNow may be able to provide unique customer value by leveraging data across different systems to extract insights that would not be possible for players who only own one system of record. This positioning allows ServiceNow to potentially extract significant value through generative AI features, whether developed internally or integrated through strategic acquisitions.

However, these upcoming years are likely to be critical for the company, and the risk of disruption remains high. For example, as Tomasz Tunguz recently shared, there could be disruptions in companies' internal processes due to AI, which could present an opportunity to replace systems of record like ServiceNow. In relation AI can potentially reduce the migration and switching cost. Further, AI creates an opportunity to not just add AI features to existing workflows, which, at a high-level, is ServiceNow’s strategy, but rather to fundamentally rethink the jobs to be done and to expand the scope of the impact that AI can have. For example, some research-driven startups may eliminate the need for ServiceNow solutions altogether, for instance, by building a system that automatically diagnoses and resolves common IT issues without human intervention. This would reduce the need for manual ticket handling and shift incident management workflows. There is also the risk of an innovator's dilemma in balancing AI adoption to stay competitive without eroding the profitability of existing products. For example, they currently operate under subscription and licensing models based on user seats and module usage, but with AI, this could shift to an outcome-based pricing model, which could present an opportunity for startups to capture some of that market share.

We don’t give financial advice on public stocks, but in weighing the Bull and Bear case, we lean towards the Bull case. The company jumped on the AI wave quickly, is executing well, and showing an ability to leverage their large installed base to drive adoption, upsell, and cross-sell. We look forward to seeing how the coming years play out for their business!

Appendix

A Index constituents YoY revenue growth and EBITDA Margin

Performance Overview:

Inception (January 2023) to date returns for the Flybridge AI Index are 120%. In comparison, over the same time period the Cloud Bessemer Index returned 29%, the S&P 500 returned 49%, the Nasdaq returned 73%, and the F-Prime Fintech Index returned 125%.

The median NTM revenue multiple was 8.6x.

The median quarterly YoY revenue growth rate was 14%.

The median LTM net income margin was 13%.